Developing shorter supply chains, strengthening domestic manufacturing

August 18th, 2022

Anyone familiar with a pendulum’s action knows how business trends develop and change over time. One strategy often leads to an opposing strategy as business conditions change. A trend toward acquisitions eventually leads to consolidation. Introducing new product lines for new markets often leads to shedding product lines and exiting those markets. A drive toward international business often leads to refocusing on domestic business. This doesn’t mean that the first decision was poor, but it reflects the dynamic nature of business.

The roles of supply chains, specifically long supply chains, have been changing lately. Longer, more complex supply chains are giving way to shorter, simpler ones. Some of the work that had been sent overseas is returning. The trend toward simplification is nothing new and will likely continue well into the foreseeable future. This is good news for domestic manufacturers.

Long supply lines are almost as old as civilization itself. The Silk Road—these days known as the Silk Routes—which connected communities in Europe, the Middle East, and the Far East, came to prominence more than 2,000 years ago and spanned 4,000 miles. Today’s Silk Routes are lengthy supply chains. They have been stretching out across the globe for decades, especially from North America and Europe to Asia. Regrettably, extended supply chains have specific challenges, like adhering to delivery schedules and maintaining quality control. And, rising wages on the supplier end make such arrangements less attractive as time goes on.

Supply Chain Shocks

Supply chain shocks are problematic. The automobile industry got a jolt from one back in 2011, following severe flooding in Thailand. The disaster affected 85 percent of the country’s provinces, and the effects lasted nearly six months. Because the nation is the 9th largest automobile manufacturer worldwide, the impact on the automotive industry was substantial.

A year later, the Mississippi River was so low that some barges couldn’t get through. Some freight typically delivered by barge had to be rerouted to go by truck or rail. The same is happening this summer in Europe. Deliveries are likely to be late and sure to be more expensive because rail and road are pricier than transportation over water.

Of course, the emergence and spread of COVID-19 created a series of supply shocks worldwide. Many governments issued stay-at-home orders and mandated business shutdowns early in 2020 as the illness spread. The damage was severe by the time most governments ended business and travel restrictions. Nearly every industrial commodity was in short supply after COVID-19’s first big wave.

Long after we had learned to combat the virus, many people were reluctant to rejoin the workforce, so recovery was not in the immediate future. Making matters worse, consumers’ spending patterns shifted. Nearly every service provider was shut down for long periods of time in the early days of the pandemic, so many consumers spent more on goods, further straining manufacturing throughout the world. The Evergreen Spring getting hung up in the Suez Canal for a week, blocking one of the world’s busiest trade routes, added more delays as other ships were redirected to take longer routes.

The war in Ukraine likewise has been severely destabilizing, upending arrangements for formerly stable food supplies for much of the world and shredding oil and gas arrangements for much of Europe.

More to Come

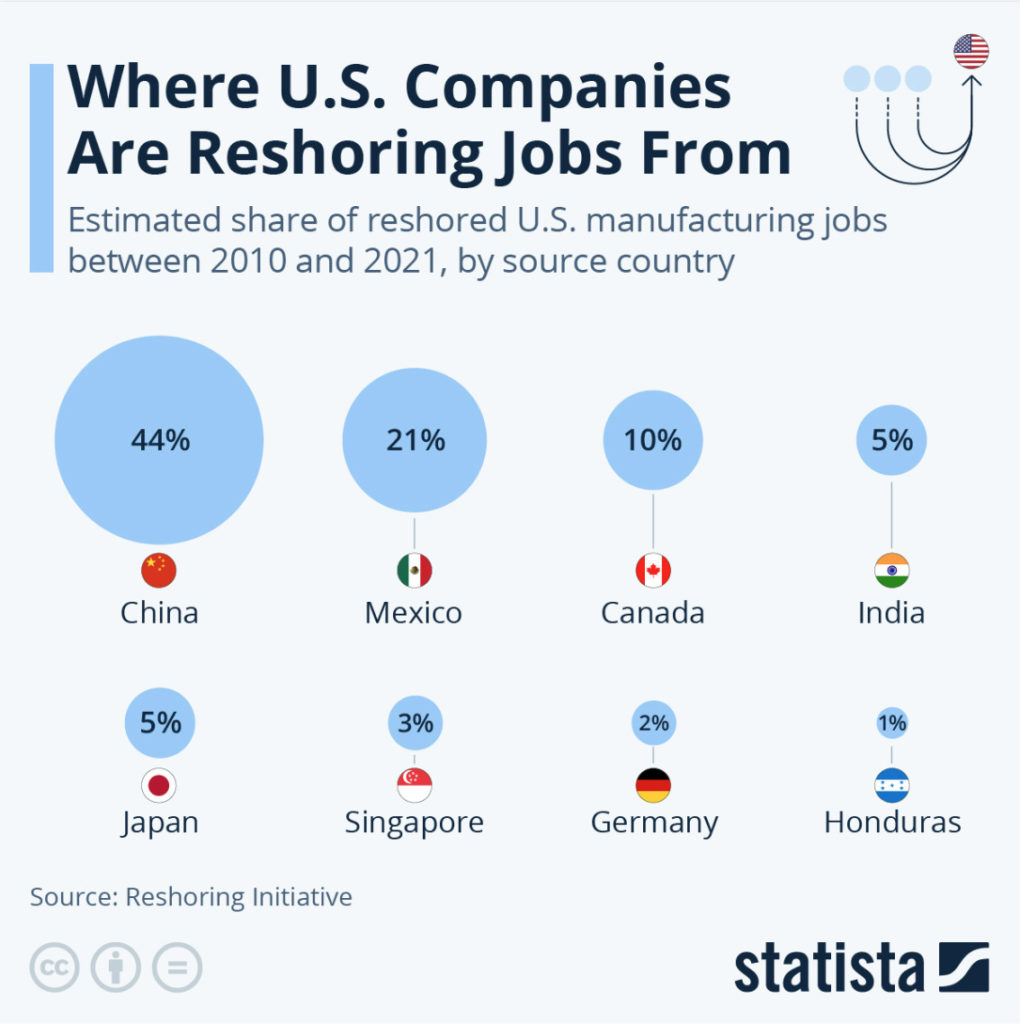

Amid these crises, a new trend emerged. The reshoring movement started small but has gathered momentum since it began more than a decade ago. Outsourced manufacturing work has been trickling from Asia back to North America and Europe for some time now, and this trend is expected to continue and perhaps accelerate.

The outcome for domestic manufacturers? More contracts and more work for suppliers and more predictability in quality and deliveries for OEMs.